| Aspect | Details |

|---|---|

| Name | N/A |

| Occupation | N/A |

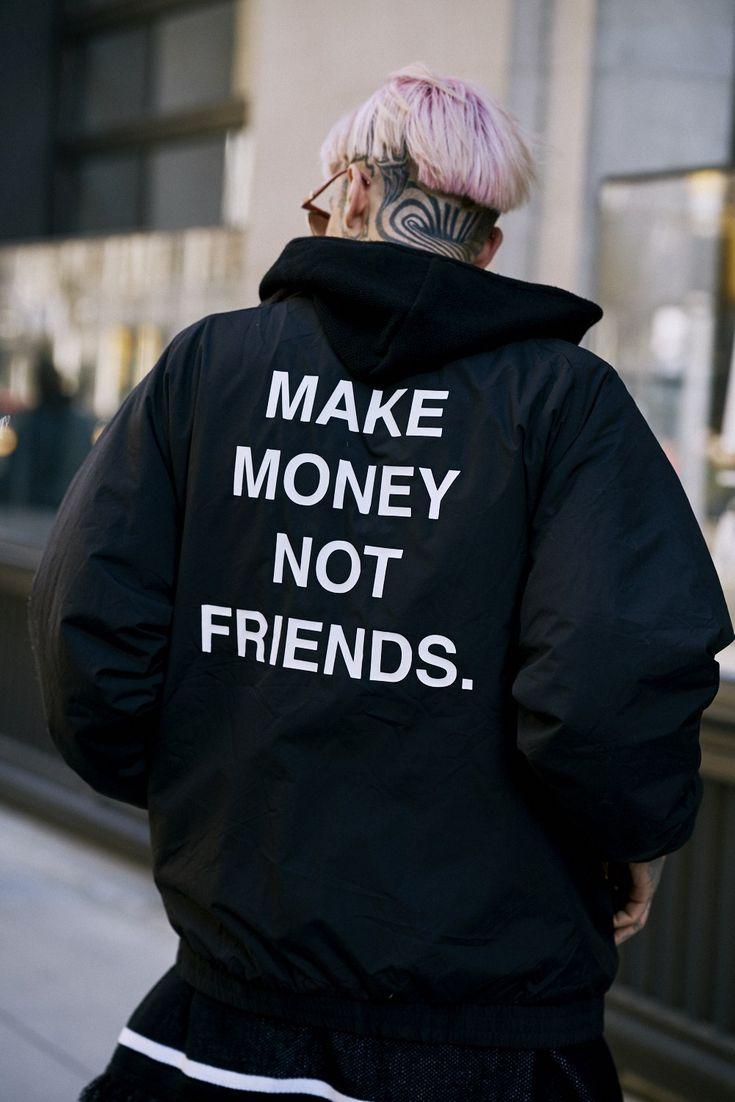

| Philosophy | Make Money Not Friends |

| Focus | Financial Success |

Table of Contents

- Biography and Philosophy

- Understanding the Phrase

- Historical Context

- Modern Interpretations

- Financial Prioritization

- Balancing Relationships and Financial Goals

- Mindset Shifts for Success

- Embracing Entrepreneurship

- Productivity Tips for Financial Success

- Importance of Financial Literacy

- Investing Wisely

- Case Studies of Success

- Challenges and Criticisms

- Long-Term Benefits

- Conclusion

Biography and Philosophy

The phrase "make money not friends" does not have a singular origin or a dedicated spokesperson. Instead, it is a collective philosophy adopted by many individuals across various sectors who prioritize financial gain over expanding their social circles. This approach often appeals to entrepreneurs, business professionals, and those involved in high-stakes industries where financial success is seen as a key measure of accomplishment.

The core philosophy of "make money not friends" revolves around the idea that financial independence and success are more reliable and rewarding than maintaining a vast network of friends. Proponents of this philosophy argue that while friendships can be valuable, they should not deter one's focus from achieving financial goals. This philosophy encourages individuals to channel their time and energy into activities that directly contribute to their financial well-being.

Adherents to this mindset believe that financial security provides the freedom to live life on one's own terms. It offers the ability to make choices without being constrained by financial limitations. The pursuit of wealth is not seen as a rejection of friendships but as a prioritization of personal goals that can ultimately lead to a more fulfilling life.

Understanding the Phrase

The phrase "make money not friends" is often misunderstood as a call to abandon social connections entirely. However, its true essence lies in the prioritization of financial goals over social interactions. This does not mean that friendships are unimportant, but rather that they should not come at the expense of financial stability and growth.

In a world where financial pressures are ever-present, this philosophy resonates with those who see financial success as a pathway to greater freedom and opportunities. The phrase suggests that while friendships are valuable, they should not overshadow the pursuit of financial independence. By focusing on making money, individuals can build a secure foundation that allows them to support themselves and their loved ones.

Historical Context

The concept of prioritizing wealth over social connections is not new. Throughout history, there have been periods where financial success was deemed more important than social bonds. During the Industrial Revolution, for example, individuals were encouraged to focus on economic gain as a means of improving their social status and quality of life.

Similarly, in the 1980s, the rise of capitalism and consumerism emphasized the importance of financial success. The mantra "greed is good" became popular, reflecting a societal shift towards valuing monetary gain over personal relationships. In this context, the phrase "make money not friends" can be seen as a modern iteration of these historical trends.

Modern Interpretations

In today's world, the phrase "make money not friends" is often associated with hustle culture and the entrepreneurial spirit. It reflects a mindset where individuals are encouraged to work hard, take risks, and prioritize financial goals over social engagements. This approach is particularly appealing to those who seek to build a business or achieve financial independence at a young age.

Modern interpretations of this philosophy emphasize the importance of financial literacy, strategic investments, and continuous self-improvement. Individuals who adopt this mindset are often seen as go-getters who are willing to sacrifice short-term social pleasures for long-term financial gains. They understand that financial success requires dedication, discipline, and a willingness to make tough choices.

Financial Prioritization

At the heart of the "make money not friends" philosophy is the idea of financial prioritization. This involves setting clear financial goals and making decisions that align with those objectives. Whether it's saving for retirement, investing in stocks, or building a business, financial prioritization requires a focused and intentional approach.

One key aspect of financial prioritization is budgeting. By creating a detailed budget, individuals can track their income and expenses, identify areas for improvement, and allocate resources effectively. This allows them to make informed decisions that support their financial goals and minimize unnecessary spending.

Another important element is investing wisely. By understanding the principles of investing and diversifying their portfolio, individuals can grow their wealth over time. This requires a willingness to learn and adapt to changing market conditions, as well as a commitment to long-term financial planning.

Balancing Relationships and Financial Goals

While the "make money not friends" philosophy emphasizes financial success, it does not advocate for the complete abandonment of social connections. Instead, it calls for a balance between nurturing relationships and pursuing financial goals. This balance is crucial for maintaining a healthy and fulfilling life.

One way to achieve this balance is by setting boundaries. By clearly defining personal and professional priorities, individuals can manage their time more effectively and avoid overcommitting to social engagements. This allows them to focus on their financial objectives while still maintaining meaningful relationships.

Additionally, it's important to cultivate relationships that support and encourage financial growth. Surrounding oneself with like-minded individuals who share similar goals can provide motivation and accountability. These relationships can serve as a source of inspiration and guidance, helping individuals stay on track and achieve their financial aspirations.

Mindset Shifts for Success

Embracing the "make money not friends" philosophy requires a mindset shift. This involves redefining success and understanding that financial independence is a key component of a fulfilling life. By adopting a growth mindset, individuals can overcome challenges and setbacks, and remain focused on their financial goals.

One important mindset shift is viewing money as a tool for personal and professional growth. Rather than seeing money as an end in itself, individuals can use it to invest in education, start a business, or pursue passions that align with their values. This perspective encourages a more intentional and purposeful approach to financial success.

Another key mindset shift is the willingness to take calculated risks. Financial success often requires stepping outside of one's comfort zone and embracing uncertainty. By taking risks and learning from failures, individuals can develop the resilience and adaptability needed to navigate the complex financial landscape.

Embracing Entrepreneurship

The "make money not friends" philosophy is particularly relevant to entrepreneurs who prioritize financial independence and business success. Entrepreneurship offers the opportunity to create something meaningful, generate wealth, and achieve personal and professional goals.

Entrepreneurs who embrace this philosophy understand the importance of hard work, dedication, and persistence. They are willing to make sacrifices and take risks in pursuit of their business objectives. By focusing on innovation and value creation, they can build successful enterprises that contribute to their financial success.

Additionally, entrepreneurship provides the flexibility to align business goals with personal values. This allows entrepreneurs to pursue ventures that are not only financially rewarding but also fulfilling and impactful. By following their passion and staying true to their vision, entrepreneurs can achieve a sense of purpose and satisfaction.

Productivity Tips for Financial Success

To achieve financial success, it is important to maximize productivity and make the most of available resources. This requires effective time management, goal-setting, and prioritization of tasks that directly contribute to financial objectives.

One useful productivity tip is to establish a daily routine that includes time for focused work, exercise, and relaxation. By creating a structured schedule, individuals can reduce distractions and increase efficiency. This allows them to allocate more time to activities that support their financial goals.

Another important tip is to set SMART goals (Specific, Measurable, Achievable, Relevant, Time-bound). By setting clear and realistic goals, individuals can track their progress and stay motivated. This approach encourages accountability and helps individuals remain focused on their financial aspirations.

Importance of Financial Literacy

Financial literacy is a critical component of the "make money not friends" philosophy. Understanding financial concepts and strategies is essential for making informed decisions and achieving financial independence.

Financial literacy involves gaining knowledge about budgeting, investing, saving, and managing debt. By educating themselves about these topics, individuals can make better financial choices and avoid common pitfalls. This empowers them to take control of their financial future and build wealth over time.

Additionally, financial literacy provides the confidence to navigate the complex financial landscape. With a solid understanding of financial principles, individuals can evaluate investment opportunities, negotiate financial terms, and plan for retirement. This knowledge serves as a foundation for long-term financial success.

Investing Wisely

Investing wisely is a key aspect of achieving financial success. By making informed investment decisions, individuals can grow their wealth and secure their financial future.

One important principle of investing is diversification. By spreading investments across different asset classes, individuals can reduce risk and increase potential returns. This requires a willingness to research and understand different investment options, such as stocks, bonds, real estate, and mutual funds.

Another important consideration is the time horizon. Long-term investments often provide better returns than short-term strategies. By adopting a long-term perspective, individuals can ride out market fluctuations and benefit from compound interest. This approach encourages patience and discipline, which are essential for successful investing.

Case Studies of Success

The "make money not friends" philosophy has been embraced by numerous successful individuals who have prioritized financial goals over social connections. These case studies demonstrate the potential for achieving financial success through dedication and focus.

One notable example is Warren Buffett, one of the world's most successful investors. Known for his frugality and disciplined approach to investing, Buffett has amassed a significant fortune by making strategic financial decisions. His emphasis on financial literacy and long-term planning aligns with the principles of the "make money not friends" philosophy.

Another example is Elon Musk, a visionary entrepreneur who has revolutionized multiple industries. Musk's relentless pursuit of innovation and financial success has made him one of the wealthiest individuals in the world. His commitment to his goals and willingness to take risks exemplify the mindset required for financial achievement.

Challenges and Criticisms

While the "make money not friends" philosophy has its merits, it is not without challenges and criticisms. Some argue that prioritizing financial success can lead to a lack of meaningful relationships and social isolation.

Critics also point out that the pursuit of wealth can result in burnout and stress. The pressure to constantly achieve financial goals can take a toll on mental and physical well-being. It's important for individuals to recognize the potential downsides and strive for a healthy balance between financial pursuits and personal fulfillment.

Additionally, some view the philosophy as overly materialistic and self-centered. They argue that true happiness and fulfillment come from meaningful connections and contributions to society, rather than financial wealth. It's important for individuals to define success on their own terms and consider the impact of their choices on themselves and others.

Long-Term Benefits

Despite the challenges, the "make money not friends" philosophy offers long-term benefits for those who embrace it. By prioritizing financial success, individuals can achieve financial independence and gain the freedom to pursue their passions and goals.

Financial success provides the ability to support oneself and loved ones, invest in personal growth, and contribute to causes that align with one's values. It also offers peace of mind and security, knowing that financial needs are met and future goals are within reach.

Furthermore, the discipline and focus required to achieve financial success can lead to personal growth and resilience. By overcoming challenges and making intentional choices, individuals can develop skills and qualities that contribute to a fulfilling and meaningful life.

Conclusion

The "make money not friends" philosophy is a mindset that emphasizes the importance of financial success over social interactions. While it may not be for everyone, it offers a framework for those who prioritize financial independence and security. By adopting this philosophy, individuals can achieve their financial goals and create a life that aligns with their values and aspirations.

Frequently Asked Questions

1. What does "make money not friends" mean?

The phrase "make money not friends" emphasizes prioritizing financial success over expanding social circles. It suggests focusing on financial goals and independence rather than constantly seeking new friendships.

2. Is it bad to prioritize money over friends?

Prioritizing money over friends is a personal choice. It is essential to strike a balance between financial success and maintaining meaningful relationships. Financial independence can provide freedom and security, but genuine connections also contribute to a fulfilling life.

3. How can I achieve financial success?

Achieving financial success involves setting clear goals, creating a budget, investing wisely, and continuously improving financial literacy. It requires dedication, discipline, and a willingness to make intentional choices that align with financial objectives.

4. Can I still have friends while focusing on making money?

Yes, it is possible to have friends while focusing on making money. The key is to prioritize relationships that support and encourage financial growth. Setting boundaries and managing time effectively can help maintain meaningful connections while pursuing financial goals.

5. Is the "make money not friends" philosophy suitable for everyone?

The "make money not friends" philosophy may not be suitable for everyone. It appeals to individuals who prioritize financial independence and success. Each person must define success on their terms and consider the impact of their choices on themselves and others.

6. How can I balance financial goals and social interactions?

Balancing financial goals and social interactions involves setting boundaries, managing time effectively, and cultivating relationships that align with personal and professional objectives. It's crucial to find a balance that allows for financial growth while maintaining meaningful connections.

For more insights on personal finance and achieving financial success, you can visit [Investopedia](https://www.investopedia.com).

S Wan Cafe: Your Gateway To A Delightful Culinary Experience

Discovering Trendy Hairstyles For Boys: A Comprehensive Guide

Unveiling The Vibrant Pulse Of Miami: A Comprehensive Guide To "Coming Up Miami"

Make Money Not Friends Wallpapers Top Free Make Money Not Friends

Make Money Not Friends Quote, Funny Money PNG Etsy

Make money not friends Typography quote tshirt design,poster, print